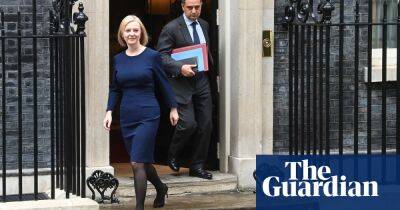

When Trussonomics arrives, the big winner may well turn out to be Labour

Since launching her bid to be prime minister in July, Liz Truss has talked non-stop about the need to challenge Treasury orthodoxy and run the economy differently. Friday marks the day when the talking ends and Britain gets a taste of what Trussonomics actually means.

Let’s be clear: Kwasi Kwarteng’s statement to MPs on Friday is much more than a run-of-the-mill fiscal event. Mini budget doesn’t really do it justice either. Most full-blown budgets matter little and are quickly forgotten. This one is a very big deal indeed.

For decades economic policy in Britain has been dominated by the idea that the government’s books need to add up. Margaret Thatcher likened her approach to the public finances to that of a housewife seeking to manage a household budget. George Osborne accused Gordon Brown’s government of “maxing out” on the nation’s credit card. Labour faced relentless questioning during the 2019 election campaign about how – in the absence of a magic money tree – it would finance its spending plans.

Trussonomics turns all this on its head. The government will borrow big, not just to finance energy support schemes for households and businesses but also for tax cuts. Far from dampening expectations since becoming prime minister, Truss has doubled down. In addition to the cuts in national insurance contributions and the scrapping of next April’s rise in corporation tax, there has been talk of lowering stamp duty and bringing forward plans to reduce income tax.

Truss and Kwarteng’s message to those querying where the money is coming from to pay for the extra spending and tax cuts is that everything will work out well in the end because the boost provided to the economy by Trussonomics will lead to faster growth and higher

Read more on theguardian.com