Watch these 5 cryptocurrencies for a potential price rebound next week

Traders dumped risky assets following the crisis and failure of Silicon Valley Bank (SVB). The S&P 500 Index plunged 4.55% while Bitcoin (BTC) is down about 9% this week.

The collapse of SVB led to a crisis in the crypto space with USD Coin (USDC) losing its peg to the U.S. dollar on reports that $3.3 billion of Circle’s $40 billion of USDC reserves were held at SVB. After trading near $0.87 on March 11, USDC has climbed up above $0.96 at the time of publication.

SVB’s failure has increased uncertainty in the short term with investors closely watching for any signs of the contagion spreading to other regional banks across the U.S.

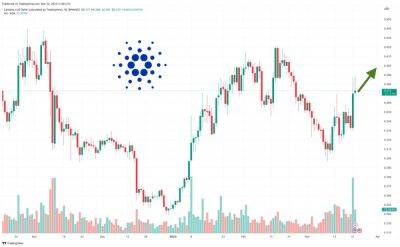

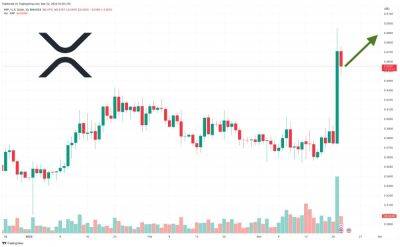

During times of uncertainty, it is best to stay on the sidelines. However, if there is no domino effect following SVB’s debacle, select cryptocurrencies may start their recovery. The cryptocurrencies selected in the article are all trading above the 200-day simple moving average, a key level watched by long-term investors to determine whether the asset is in a bull or bear phase.

Let’s study the charts of Bitcoin and the four altcoins that may outperform if the sector witnesses a recovery over the next few days.

Bitcoin has corrected back to the 200-day SMA ($20,389). Buyers are expected to defend the level with all their might because a break below it could intensify selling.

On the way up, the 20-day exponential moving average ($22,042) is likely to act as a major hurdle. If the price turns down sharply from the 20-day EMA, the BTC/USDT pair may retest the support at the 200-day SMA. If this level cracks, the pair may slide to $18,400 and then to $16,300.

If bulls want to prevent the decline, they will have to drive the price above the 20-day EMA. If they manage to do that, the pair may pick up

Read more on cointelegraph.com