UK’s most vulnerable face cost-of-living crunch as Rishi Sunak targets better-off

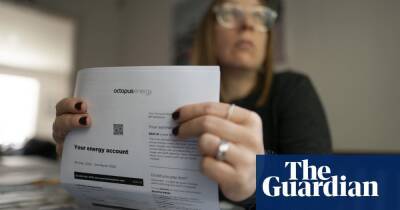

Britain’s most vulnerable households will face the full force of the biggest squeeze on living standards on record after Rishi Sunak targeted better off workers for help in his £9bn mini-budget package of tax and duty cuts.

The chancellor responded to the highest inflation in three decades with a 5p a litre cut in fuel duty and a £3,000 increase in the threshold for national insurance contributions but faced immediate and widespread criticism for failing to shield pensioners and those dependent on state benefits from the impact of a cost of living crisis.

In what he boasted was the biggest package of tax cuts in a quarter of a century, Sunak cut fuel duty by 5p a litre – taking prices back to their level of a week ago – and said the NI change would benefit the average worker by about £6 a week.

In the most surprising move, the chancellor then announced a 1p cut in income tax to 19p, which will come into force in April 2024, the month before the day earmarked by the government for the general election.

The independent Office for Budget Responsibility (OBR) said the spring statement had given back only a sixth of the tax increases announced by Sunak during his two years as chancellor and that even after the measures living standards would fall by more than 2% this year – what it said would be the steepest drop since records began in the 1950s.

A snap poll carried out by YouGov on Wednesday suggested the public were underwhelmed by Sunak’s spring statement. Just 6% of people said he had done enough to tackle the cost of living, while 69% felt he had not done enough.

Living standards are expected to fall sharply as wages and state benefits fail to keep pace with rising prices. The Office for National Statistics said on Wednesday

Read more on theguardian.com