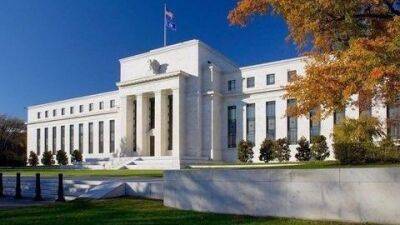

U.S. Fed Opens The Door For Crypto Banks To Enter Traditional Banking System

The U.S. Federal Reserve has announced its final guideline that might allow crypto banks to enter the banking system. The central bank will set up a three-tiered system for determining whether financial institutions have access.

As part of the final guideline, institutions with novel financial products will have access to the fed's «master accounts» and payment services.Notably, this might impact the Wyoming-based custodian bank that had filed a lawsuit against the Federal Reserve earlier this year in June and might finally benefit from this move.

In a statement, Fed Vice Chair Lael Brainard said, «The new guidelines provide a consistent and transparent process to evaluate requests for Federal Reserve accounts and access to payment services in order to support a safe, inclusive, and innovative payment system.»

The three-tiered framework serves as a direction in evaluating the risk level of the applicant institution. In the case of Tier 1, it is for federally insured applicants. Tier 2, on the other hand, is not for the federally-insured applicant but is still subject to «subject prudential supervision by a federal banking agency.» Tier 3 is for applicant institutions that are «not federally insured and not subject to prudential supervision by a federal banking agency.” This category is where Wyoming crypto banks, such as Custodia and Kraken, would most likely fit.

With Fed approval, crypto banks will no longer require partnerships with traditional banks that serve as their intermediaries, as they will be sidelined, and their financial systems will be opened up to these banks. It will give crypto banks the option to perform a duo function. Noelle Acheson, Head of Market Insights at Genesis Trading, hailed the Fed's

Read more on investopedia.com