THG shares fall after failed takeover talks with Apollo

THG has ended talks about a possible takeover bid by Apollo saying the private equity company’s offer is an inadequate valuation of the online retail tech company.

THG, formerly known as the Hut Group, said that after a “short period of discussion” to give Apollo the chance to up its offer for the company, its board has unanimously decided to “terminate all discussions”.

“It has become clear to the board, supported by shareholders representing a majority of THG’s issued share capital, that there is no longer any merit in continuing to engage with Apollo,” the company said on Friday. “Consideration and rejection of the indicative proposal has been on a basis consistent with all previous offers for the company, some a matter of public record, which were also rejected based upon inadequate valuations and the nature of those offer structures.”

THG, which owns brands including LookFantastic and MyProtein, has been subject to takeover interest from investors including the property tycoon Nick Candy, and a bid from Belerion Capital and King Street Capital Management that valued the business at £2bn.

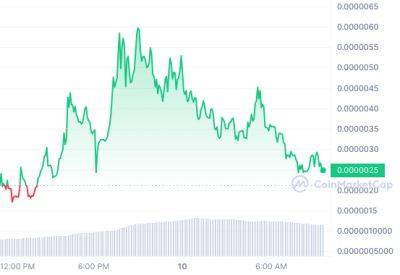

Shares in the company fell by almost 10% as investors, who have wiped out 90% of its market value since THG listed in London in September 2020, reacted to the latest failure to strike a takeover deal.

“The misery around THG goes on,” said Russ Mould, investment director at AJ Bell. “Investors hoping a takeover would put both them and the company’s torrid existence as a public entity out of their misery will be disappointed.”

The company, co-founded in 2004 by Matt Moulding and fellow former Phones4u executive John Gallemore, became an investor favourite after floating in London at an opening valuation of £5.4bn.

The valuation has since

Read more on theguardian.com