The U.S. is weaker now than when we downgraded in 2011, former S&P ratings chairman says

The U.S. is in a weaker position now than when S&P downgraded its sovereign credit rating in 2011, according to the former chairman of the agency's Sovereign Rating Committee.

The world's largest economy is once again facing the prospect of a government shutdown unless lawmakers in Washington can pass a spending bill before an Oct. 1 deadline.

House Speaker Kevin McCarthy cannot afford to lose more than four votes among fellow Republicans in the House of Representatives, but faces resistance from hard-right members within his caucus, who are demanding deeper domestic spending cuts.

Moody's earlier this week warned that a government shutdown would harm the country's credit, after Fitch downgraded the long-term U.S. sovereign credit rating by one notch in August on the back of the latest political standoff over raising the debt ceiling.

S&P controversially downgraded the long-term credit rating from the AAA representing a «risk free» rating to AA+ as early as 2011, citing political polarization after another debt ceiling squabble in Washington.

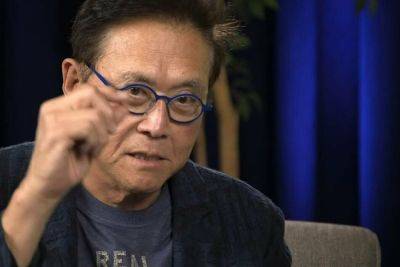

John Chambers, former chairman of the Sovereign Rating Committee at S&P Global Ratings at the time of that 2011 downgrade, told CNBC's «Capital Connection» on Tuesday that a government shutdown is likely and that the whole episode was a «sign of weak governance.»

This was a factor that led to S&P's downgrade of 2011, and Chambers said the U.S. fiscal position is now even weaker than it was back then.

«Right now the deficit of the general government — which is the federal and the local governments combined — is over 7% of GDP and the government debt is 120% of GDP. At the time, we forecasted that it might get to 100% of GDP, and the government ridiculed us for being too

Read more on cnbc.com