The S&P 500 just had its worst first half in more than 50 years, which 'stressed' this classic investment strategy

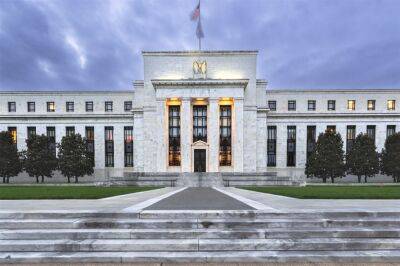

The S&P 500 Index, a barometer of U.S. stocks, just had its worst first half of the year going back over 50 years.

The index fell 20.6% in the past six months, from its high-water mark in early January — the steepest plunge of its kind dating to 1970, as investors worried about decades-high inflation.

Meanwhile, bonds have suffered, too. The Bloomberg U.S. Aggregate bond index is down more than 10% year to date.

The dynamic may have investors re-thinking their asset allocation strategy.

More from Personal Finance:IRA rollovers often come with higher investment feesStudents are taking on 'unsustainable debt' for collegeJust 1% of people got a perfect score on this Social Security quiz

While the 60/40 portfolio — a classic asset allocation strategy — may be under fire, financial advisors and experts don't think investors should sound the death knell for it. But it does likely need tweaking.

«It's stressed, but it's not dead,» said Allan Roth, a Colorado Springs, Colorado-based certified financial planner and founder of Wealth Logic .

The strategy allocates 60% to stocks and 40% to bonds — a traditional portfolio that carries a moderate level of risk.

More generally, «60/40» is a shorthand for the broader theme of investment diversification. The thinking is: When stocks (the growth engine of a portfolio) do poorly, bonds serve as a ballast since they often don't move in tandem.

The classic 60/40 mix encompasses U.S. stocks and investment-grade bonds (like U.S. Treasury bonds and high-quality corporate debt), said Amy Arnott, a portfolio strategist for Morningstar.

Until recently, the combination was tough to beat. Investors with a basic 60/40 mix got higher returns over every trailing three-year period from mid-2009 to

Read more on cnbc.com