The energy sector isn’t ‘broken’, it’s cooking on gas – if you’re a profit-hungry shareholder

C entrica, the company that owns British gas, has posted record profits of £3.3bn for 2022, more than tripling its results in 2021. The company also announced it will pay a dividend to shareholders of more than £200m, and will spend a further £300m on share buybacks. With the cost of living crisis deepening, and following the prepayment meter scandal, the “monster” results have prompted outrage. That anger is more than justified.

British Gas is, of course, hardly the only energy company announcing staggering windfalls. In recent weeks, Shell reported profits of over £32bn for 2022, while BP declared £23bn for the year. As with British Gas, historic profits have been translated into spectacular rewards for shareholders. BP, for instance, announced £11.8bn of shareholder payouts, over 14 times as much as it invested in “low carbon” activities. This is how the energy crisis, climate emergency and inequality intersect and intensify. As household bills soar, the energy companies are using surging profits to increase shareholder payouts and double down on fossil fuel production.

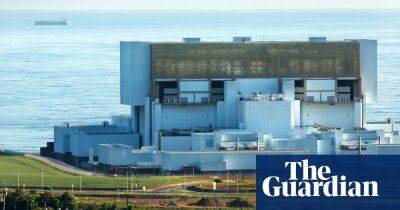

The profits of the energy sector are inseparable from soaring wholesale gas prices since Putin’s invasion of Ukraine. However, looking beneath the bonnet of Centrica reveals three areas where exorbitant profits are being made: its commodity trading segment, where profits grew 20-fold to £1.4bn; the UK’s woefully under-supplied gas storage sector, where profits more than quadrupled to £339m; and energy generation, where Centrica made a phenomenal 60% margin, thanks in large part to its stake in EDF UK’s nuclear fleet.

Higher bills also feed their way into rising profits. Remarkably, Centrica’s UK electricity supply segment produced its largest profit

Read more on theguardian.com