Tether diversifying with Bitcoin, investors diversifying with Tradecurve

Disclaimer: The text below is an advertorial article that is not part of Cryptonews.com editorial content.

Tether, the issuer of the popular stablecoin USDT has often come under suspicion from the crypto industry in the past. In a recent report, they explain how they have changed their reserves, diversifying with Bitcoin. Tradecurve also looks to challenge and fix problems in the industry and financial markets, by offering a new and decentralized way to trade financial products.

>>BUY TCRV TOKENS NOW<<

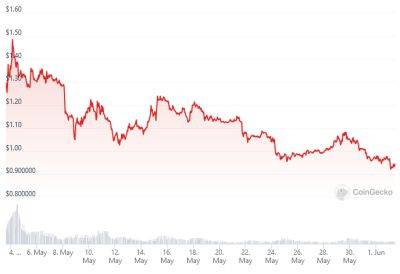

In an ‘Attestation report’, Tether has revealed its intention to regularly purchase Bitcoin using its surplus profits. The report by accounting firm BDO Italia, indicated that Tether earned $1.48 billion in profit during the first quarter of the year.

With its ‘excess of reserves’ doubling to $2.4 billion, Tether plans to accumulate bitcoin to strengthen its financial position. They're planning to strengthen their reserves portfolio by allocating up to 15% of their net realized operating profits into buying Bitcoin (BTC).

This move aligns Tether with other institutional giants, such as MicroStrategy, that have been actively acquiring BTC. Tether's conservative investment strategy also includes a significant investment in gold.

By adding bitcoin to their investment strategy, Tether's hoping to cash in on the digital asset's potential growth while showing themselves a trusted and reliable financial infrastructure provider.

They no longer rely on ‘commercial paper’, which is a type of short-term, unsecured debt issued by companies. Instead holding a lot of money in safer places, such as U.S. Treasury bills.

The secret to a good portfolio is to diversify, and this is what Tether has been doing. Many crypto investors

Read more on cryptonews.com