Terra Luna Classic Price Prediction for 2023 – Can LUNC Go to $1?

Terra Luna Classic struggles to hold support above support at $0.00014, hours ahead of the New Year. The previous year – 2021, saw investors and crypto enthusiasts beam with the hope that 2022 would be laced with world-class developments and key milestones.

Ordinary people casually discussed cryptocurrency, mentioning how Ethereum (ETH) differs from Bitcoin (BTC). Sports arenas were treated to flashy promotion campaigns from companies like FTX and Crypto.com. 2021 allowed nonfungible tokens, better known as NFTs hit new milestones amid increased adoption in the mainstream economy.

Fast forward a year later, palatable topics turned bitter, starting with the collapse of Terra (LUNA) and its stablecoin ecosystem powered by TerraUSD (UST). From here, it has been a downtrend for the larger cryptocurrency and worse for companies like Three Arrows Capital, Voyager Digital and Celsius Network.

When investors were finally looking forward to a year-end rally, Sam Bankman-Fried’s FTX exchange collapsed after suffering a liquidity crunch in November. FTX, its sister company Alameda Research, and over 100 entities under their umbrella filed for bankruptcy proceedings under Chapter 11. BlockFi exposure to FTX did not get a chance to survive and ended up filing for bankruptcy.

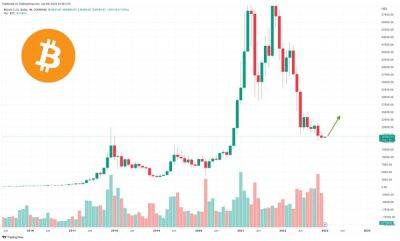

Terra Classic price dodders at $0.0000146 while bulls work around the clock to defend immediate support provided by the falling dotted trend line. A green candle is building momentum, but it will become more relevant if the price steps and holds above resistance at the 50-day Simple Exponential Moving Average (EMA) near $0.0001546.

The potential short-term bullish outlook in LUNC awaits another move beyond the next falling trend line, as shown on the 12-hour time

Read more on cryptonews.com