Terra LUNA Classic [LUNC] Price Prediction 2025-2030: LUNC traders shouldn’t worry

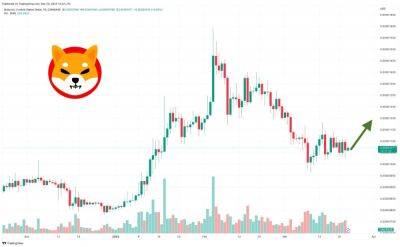

The recent crypto market dip following the Silicon Valley Bank’s (SVB) collapse has weighed heavily on Luna Classic (LUNC), the cryptocurrency that powers the original but now largely defunct Terra blockchain ecosystem.

LUNC was at the center of the collapse of the Terra ecosystem in May 2022. The coin has also been severely affected by the collapse of the crypto exchange FTX in November last year. Its market capitalization has dropped from $1.5 billion to $1.0.4 billion since then.

Transactions on the Terra 2.0 blockchain are validated through the proof-of-stake (PoS) consensus mechanism.

The leading cryptocurrency, Ethereum (ETH), has also transitioned from a proof-of-work to a proof-of-stake mechanism. This has only made the competition among PoS blockchains tougher.

The network has 130 validators working at a given point of time. As a PoS platform, it is considered being a very eco-friendly token.

A stablecoin is intended to safeguard coin holders against the volatility of other cryptocurrencies. It is pegged to either a fiat currency such as USD or to a supporting cryptocurrency. Terra USD (UST) was pegged to Luna Classic (LUNC- then, only LUNA).

This is where the problem began. A cryptocurrency is in no way equivalent to gold reserves. As LUNA prices became destabilized, it adversely affected UST prices too, and the entire stablecoin system collapsed in May 2022.

For the initial few years, LUNC kept performing well. And, it was even among the top 10 cryptocurrencies by market value by the end of 2021.

But the Terra system collapsed in May 2022, leading to a fork. It basically launched a new version of Luna. The Terra Ecosystem Revival Plan 2 was implemented according to which both versions of the Luna token

Read more on ambcrypto.com

![How will Chainlink [LINK] fare in the next quarter? This data suggests… - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/3/23/61177_pg9w6.jpg)