Terra Co-Founder Indicted in South Korea on Violations of Capital Markets Law

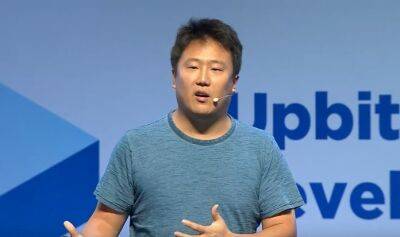

Daniel Shin, the co-founder of Terraform Labs—once one of the most valuable crypto exchanges before its flagship TerraUSD (UST) stablecoin imploded last year—was indicted by South Korean authorities on Tuesday.

Ten individuals, all directly linked to Terra and its operations, were indicted on charges including illegal trading, breach of trust, and violation of capital markets law. Prosecutors have seized $184.7 billion in assets belonging to the individuals.The indictment comes a month after Do Kwon, another Terra co-founder, was arrested in Montenegro.

The indictment centers on the sudden collapse of TerraUSD and its sister coin Luna last year. The stablecoin, which was intended to maintain a $1 peg, fell to 35 cents on May 9, 2022, while Luna, its sister coin designed to stabilize UST’s price, plunged from $80 to pennies a few days later. Terra subsequently collapsed in a $60 billion wipeout.

Kwon was wanted by South Korean authorities when he was apprehended in Montenegro and his location had been unknown prior to his arrest. Shin's lawyer claims his client had left Terra two years prior to its implosion and had voluntarily returned to South Korea to cooperate with authorities.

Terra's collapse set in motion a sustained plunge in cryptocurrency prices last year, ushering in a "crypto winter." The price of bitcoin, the world’s largest crypto coin by market cap, tumbled almost 70% last year, bottoming out at $15,500 in late November after peaking just under $69,000 the year before. Several exchanges failed during last year's crypto winter, including the high-profile collapse of FTX in early November.

Prices have since rebounded, with bitcoin briefly trading above $30,000 earlier in April, the highest level in nine

Read more on investopedia.com