SOL price risks 20% drop despite Grayscale Solana Trust's retail debut

On April 17, the price of Solana (SOL) crept lower in the wake of similar price moves across the top-ranking cryptocurrencies, including Bitcoin (BTC) and Ether (ETH).

SOL's price dropped over 4% under $24.50 despite rising to $26 — a two-month high — earlier in the day.

In comparison, BTC's and ETH's prices dropped 3.5% and 3%, respectively, hinting at a bearish start to the week.

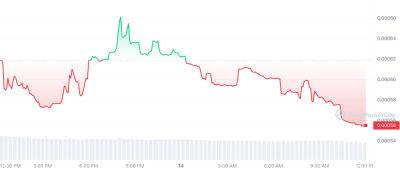

The SOL/USD selloff on April 17 started after it entered its 2023 resistance range.

Notably, the $25-27 price area has capped Solana's upside attempts since January 2023. Testing it as resistance has preceded 25-40% corrections on multiple occasions this years, as illustrated below.

The possibility of undergoing a sharp bearish reversal in April has now increased as SOL's price returns into the range and its daily relative strength index (RSI) hangs around the overbought threshold of 70.

In this bear scenario, the immediate downside target appears to be around $20, about 20% lower than the current prices.

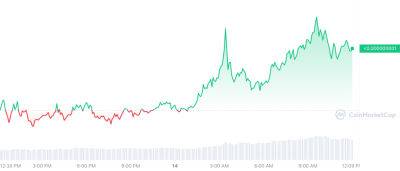

Conversely, a decisive breakout above the $25-27 price range could have SOL price climb toward $30, which served as support in August-October 2022.

Such a breakout could extend until $35 over the next few months, and this level coincides with SOL's 50-week exponential moving average (the red wave in the chart below).

On April 17, U.S.-based Grayscale Investments announced that its Grayscale Solana Trust has begun trading on OTC Markets under the symbol: GSOL.

Related: Solana overcomes FTX fiasco — SOL price gains 100% in Q1

To recap: the Grayscale Solana Trust is a security that derives its value from the SOL's spot price. In doing so, the trust enables investors to gain exposure in the Solana market while avoiding the challenges of buying,

Read more on cointelegraph.com