Singapore's UOB expects 'some upside' to interest income after Fed rate hike

Singapore'sUnited Overseas Bank is expecting «some upside» in interest income in the next quarter, after the U.S. Federal Reserve announced a fresh rate hike overnight.

UOB's core net profit jumped 35% to 1.5 billion Singapore dollars ($1.13 billion) in the second quarter from a year ago. Its net interest income for the quarter grew 31% from a year ago — boosted by robust net interest margin that expanded 50 basis points to 2.13% on higher interest rates, the Singapore-based lender said in a statement released early Thursday.

Net interest margin, a measure of lending profitability for banks, is the difference between interest earned and interest paid.

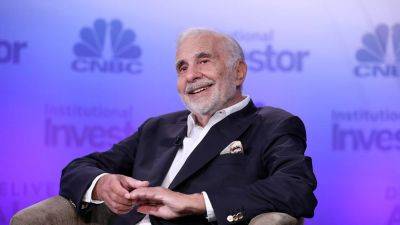

«We are hopeful that [net interest margins] will stay for the following quarter, with some upside biasness following this morning's announcement by the Fed,» UOB chief financial officer Lee Wai Fai told CNBC's JP Ong on "Street Signs Asia" in an exclusive interview Thursday.

Overnight on Wall Street, the Fed raised interest rates by 25 basis points, taking its benchmark borrowing costs to a target range of 5.25%-5.5% — the highest level in more than 22 years.

Financial markets had completely priced in the widely anticipated move. The midpoint of that target range would be the highest level for the benchmark rate since early 2001.

Shares of UOB, one of Singapore's largest lenders, rose 0.7% to a three-month high on Thursday.

The stock was broadly in line with the benchmark Straits Times Index in Singapore, and slightly below the 1% gain for the MSCI Asia ex-Japan.

«We think that loans will be repriced and that we will be able to manage our cost of funding a lot stronger mainly because of the flight to quality for the Singapore depositors,» Lee said.

Southeast Asia's

Read more on cnbc.com