Shiba Inu: Traders keep tabs on the SHIB price amid low volatility

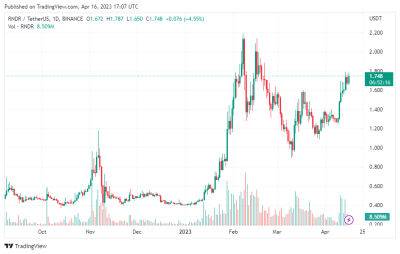

Following a week afflicted with consolidation, Shiba Inu [SHIB] has remained one of the tokens traders have kept their gaze on. However, the past week’s performance was not the catalyst that propelled the action. Rather, the futures open interest on SHIB has been rising since 14 March.

How much are 1,10,100 SHIB’s worth today ?

A high open interest implies that a large number of traders have taken active positions in a derivatives contract. At press time, a total of 2.46 trillion SHIB contracts were opened , according to data from Coinglass.

Declining open interest means that the market is liquidating and implies that the predominant price trend was coming to an end. In this case, the flow of money into futures or options contracts slows down.

Source: Coinglass

As for the situation at the time of writing, it means that the market could be unguarded from a short squelch and liquidation. But this was happening at a time when volatility was low . Hence, SHIB’s probability of consistent price swings was minimal.

Recently, SHIB has been retesting a resistance that puts bulls at risk of loss. But figures from the derivatives information tracker revealed that only $37,580 has been liquidated in the last 24 hours.

Liquidation describes a case where open long or short positions have been forcefully closed due to the inability to meet margin conditions on a bullish or bearish bet.

The SHIB condition implies that most of the contracts opened by traders have not been triggered. And this was largely due to the price drifting around the same region in the last few days.

Source: Coinglass

At the time of writing, the SHIB price action was still the same as it moved sideways. According to CoinMarketCap , the token value

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com