Russia rakes in nearly $20bn from oil exports in May

Russia raked in around $20bn (£16.6bn) from oil exports in May, as revenues bounced back to prewar levels in a setback to western efforts to choke off its economy following its invasion of Ukraine.

Yields from shipping crude and oil products rose 11% from a month earlier despite a 3% fall in exports, according to the International Energy Agency’s monthly report.

Western nations have imposed sanctions on Russian oil and gas – the Kremlin’s largest source of revenues.The US banned Russian fuel imports, while the UK and the EU have agreed to phase out their use.

However, Asian nations including China and India have ramped up their imports of Russian fuel, enticed by record discounts of more than 30% on Brent crude.

Russia has been able to cope with the discounts due to the surge in the price of Brent crude. Urals, Russia’s main export blend, averaged $78.81 a barrel in May, up almost 12% from a month before.

Oil prices are up 70% over the last year, at about $121 a barrel. Although the price came down this week on fears the US Federal Reserve will surprise markets with a higher-than-expected interest rate hike.

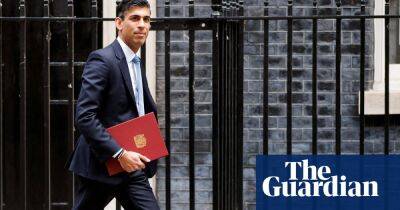

The US government appears poised to follow the UK chancellor, Rishi Sunak, in introducing a windfall tax on excessive oil company profits.

Goldman Sachs said last week that oil prices could reach $140 this summer, triggering more pain at the pumps. Britons are facing record petrol and diesel prices due to a weakened pound and a squeeze on refining capacity.

Wholesale gas prices are also rising as an extended outage at the Freeport liquefied natural gas (LNG) plant following a fire at the US facility, and the curtailment of supplies via the Russian Nord Stream 1 pipeline, stoked supply concerns.

The gas contract for within-day

Read more on theguardian.com