Price analysis 6/2: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

The United States equities markets rallied sharply on June 2 even though the nonfarm payrolls in May rose 339,000, blowing past economists’ expectations of a 190,000 increase. A few analysts pointed out that the market was possibly encouraged by the slower growth rate of hourly earnings which was slightly below estimates and an uptick in the unemployment rate.

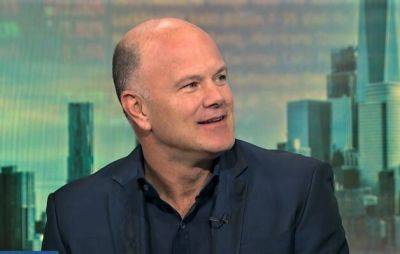

The rally in the equities markets failed to act as a tailwind to the cryptocurrency markets, which remain stuck in a range. Galaxy Digital CEO Mike Novogratz said in an interview with CNBC that the lack of enthusiasm in the crypto markets was due to absence of institutional buying.

Bitcoin’s (BTC) historical performance in June does not give a clear advantage either to the bulls or the bears. According to CoinGlass data, between 2013 and 2022, there have been an equal number of positive and negative monthly closes in June.

Will buyers defend the respective support levels and start a strong recovery in Bitcoin and select altcoins? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin has been trading inside a descending channel pattern for the past few days. The price closed below the 20-day exponential moving average ($27,239) on May 31 but the bears are struggling to maintain the lower levels.

The bulls will try to push the price back above the 20-day EMA. If they do that, the BTC/USDT pair could reach the resistance line where the bears are expected to mount a strong defense.

If the price turns down from the resistance line, it will signal that the pair may extend its stay inside the channel for some more time. The crucial support to watch on the downside is $25,250 because a break below it will indicate that bears are in control.

The first sign of

Read more on cointelegraph.com