Price analysis 12/26: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

The cryptocurrency markets are trading at record low volatility as investors have largely stayed away during the holiday season. That could be because investors are unsure about the cryptocurrencies that could lead the next bull run.

Cumberland senior research analyst Steven Goulden said in a “Year in Review” report that he expects four “emerging narratives” to lead the crypto space over the next six to 24 months. Goulden anticipates growth in nonfungible tokens, Web3 apps and games. He expects export-oriented nations to add Bitcoin (BTC) and Ether (ETH) as reserve assets and if that happens, it could be a huge positive.

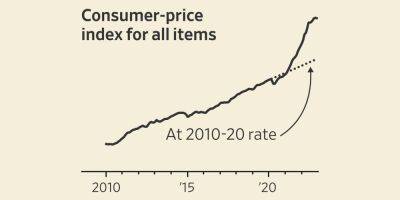

Jared Gross, head of institutional portfolio strategy at JPMorgan Asset Management, holds a different view. While speaking to Bloomberg, Gross said that the bear market had broken the notion that Bitcoin could act as a form of digital gold or an inflation hedge. He added that large institutional investors have stayed away from the crypto sector and that approach was unlikely to change anytime soon.

Could the S&P 500 index (SPX) and the cryptocurrency sector witness a recovery in the next few days? Let’s study the charts to find out.

The S&P 500 index (SPX) turned down sharply from the downtrend line and tumbled below the 50-day simple moving average (3,885) on Dec. 16. Buyers tried to push the price back above the 50-day SMA on Dec. 21 but the bears held their ground.

The sellers pulled the price below the immediate support of 3,795 on Dec. 22 but the long tail on the candlestick shows strong buying at lower levels. The bulls will again try to thrust the price above the moving averages and challenge the downtrend line. A break and close above the downtrend line could indicate a potential trend change.

Contrari

Read more on cointelegraph.com