Price analysis 11/29: BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON, LINK, AVAX

Bitcoin (BTC) is trying to sustain above the overhead resistance of $38,000 for the second consecutive day and start the next leg of the uptrend. The excitement among market observers may have increased after the United States Securities and Exchange Commission (SEC) delayed its decision on the applications of Franklin Templeton and Hashdex exchange-traded funds.

Bloomberg ETF analyst James Seyffart speculated in a X (formerly Twitter) post that the SEC may have taken this step “to line every applicant up for potential approval by the Jan. 10, 2024 deadline.”

While many analysts believe that the ETF listing will be a watershed moment for Bitcoin, Genesis Trading head of derivatives Joshua Lim cautioned in a X post that traditional finance investors have already bought the rumor and may exit the trade close to the ETF announcement when retail tries to get in.

However, the macroeconomic conditions in early 2024 may limit the downside. Pershing Square Capital Management CEO and founder Bill Ackman said in an interview with Bloomberg that the U.S. Federal Reserve will cut rates sooner than people expect. He anticipates rate cuts to start in Q1 instead of the market expectations of the middle of the year.

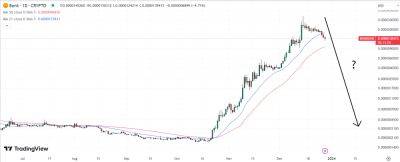

Could Bitcoin and altcoins witness a shallow correction before resuming their uptrend?

Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin again rose above the $37,980 resistance on Nov. 28, but the bulls could not achieve a close above it. This shows that the bears are fiercely defending the level.

The repeated retest of a resistance level tends to weaken it. If bulls sustain the price above the 20-day exponential moving average ($36,820), the possibility of a rally to $40,000 improves. This level may act

Read more on cointelegraph.com