Price analysis 1/2: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, LTC

The S&P 500 index (SPX) fell 19.4% and the Nasdaq nosedived 33.1% in 2022, recording the worst performance since 2008. The crypto markets also had a horrendous year with Bitcoin (BTC) falling roughly 65% in 2022. In comparison, the United States dollar, which is perceived to be a safe haven, rallied nearly 9%, its best year since 2015.

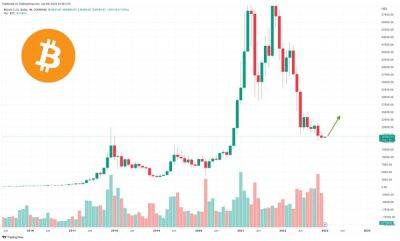

There are several green shoots visible for the cryptocurrency sector for 2023. The U.S. dollar index (DXY), which usually moves in inverse correlation with Bitcoin may have topped out. This increases the likelihood that select cryptocurrencies may be close to forming a bottom.

Several traders miss buying at lower levels because they attempt to catch the bottom. Instead, long-term investors who believe in the crypto story may consider building a portfolio or adding positions in batches. Thus, they will have some skin in the game and not repent when the next bull move begins.

Could the U.S. dollar index continue its correction and will that benefit risky assets? Let’s study the charts to find out.

The bears tried to extend the correction last week but the bulls managed to defend the 3,764 level. This indicates that the bulls are trying to form a higher low in the S&P 500 index.

The 20-day exponential moving average (3,880) is sloping down and the relative strength index is near 45, suggesting that bears have a slight edge. If bulls want to gain the upper hand, they will have to push the price above the moving averages.

That could open the doors for a possible recovery to the downtrend line where the bears may again mount a strong defense. Buyers will have to pierce this resistance to signal a potential trend change.

On the contrary, if the price turns down from the 20-day EMA and plummets below

Read more on cointelegraph.com