Number of UK households with large debts rises by a third

The number of UK households struggling with large debts increased by a third in 2021, even before the winter rise in energy prices and the removal of the £20 uplift in universal credit payments, research suggests.

Analysis of Bank of England research carried out by the Jubilee Debt Campaign found in September 2021 almost 10% of households reported that loan and interest repayments were a heavy financial burden, a 35% increase on the previous year’s figures.

Households also reported that their average monthly loan repayments reached a record £373 in 2021, up 22% on the year before and the highest figure for at least a decade.

The campaign group’s analysis is based on a survey of more than 6,000 households which was carried out in September 2021. Since then, millions of households have seen energy bills rise and are due to see a further increase next month.

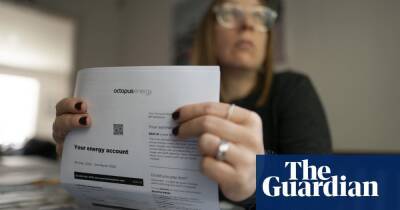

The rise in Ofgem’s price cap in October, and the failure of a number of low-cost energy suppliers, led to some customers seeing bills increase by hundreds of pounds. On 1 April, a hike in the price cap means the average household is set to experience a 54% rise in bills.

The temporary £20 a week increase in universal credit introduced at the start of the pandemic was phased out at the end of September.

Surging food and petrol costs have added to the strain on finances since the research was done, and the Jubilee Debt Campaign said the rising cost of living threatened “to push people who are already living on the edge further into debt and poverty”.

The increase in the number of households reporting that their debts were a heavy financial burden followed two years of falls, but the campaign group said it suggested that measures to ease the impact of the pandemic had not helped

Read more on theguardian.com