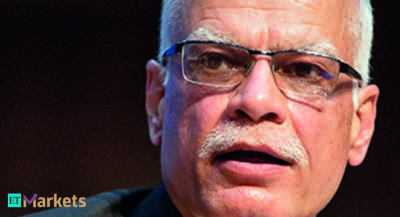

Next year's I-T return to have separate column for crypto income: Revenue Secretary Tarun Bajaj

Income tax return forms from next year will have a separate column for making disclosures on gains made from cryptocurrencies and paying taxes, Revenue Secretary Tarun Bajaj said on Wednesday.

The government will from April 1 charge a 30 per cent tax plus cess and surcharges, on such transactions in the same manner as it treats winnings from horse races or other speculative transactions.

In an interview with PTI, Bajaj said gains from cryptocurrencies were always taxable and what the Budget proposed is not a new tax but providing certainty over the issue.

Also Read: If LIC IPO goes well, Govt will be able to achieve FY22 divestment target: Revenue Secy Tarun Bajaj

"The provision in the Finance Bill is related to taxation of virtual digital assets. It is to bring certainty in taxation of cryptocurrencies. It does not convey anything on its legality which would come out once the Bill (on regulating such assets) is introduced in Parliament,” he said.

The government is working on legislation to regulate cryptocurrencies, but no draft has yet been released publicly.

Follow our LIVE blog Nirmala Sitharaman Interview

In the meanwhile, a central bank-backed digital currency will start circulating in the next fiscal to usher in cheaper, more efficient currency management.

The 30 per cent plus applicable cesses and surcharge of 15 per cent on income above Rs 50 lakh will have to be paid on income from cryptocurrencies, he said adding the income tax return form from next year will have a separate column to declare gains from crypto.

"Next year ITR form will show a separate column for crypto. Yes, you will have to disclose,” he said.

The launch of 'Digital Rupee' by RBI as well as a 30 per cent tax from April 1 on profits from digital asset

Read more on moneycontrol.com

moneycontrol.com

moneycontrol.com