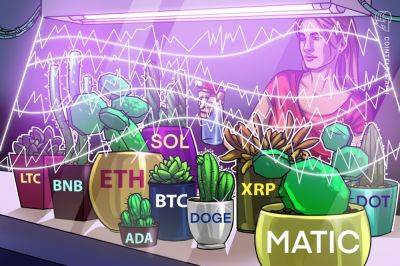

Litecoin Price Prediction as Halving Event Approaches – Can LTC Reach $1,000?

The Litecoin (LTC) price has risen by a slight 0.5% in the past 24 hours, yet its move to $91.77 still means it's down by 6% in the last seven days.

Despite its negative response to the ruling in the Ripple-SEC case (which harmed other Bitcoin forks), LTC remains up 18% in the last 30 days and by 57% in the past year.

And it's possible that the altcoin will see further gains in the next few weeks, as the market anticipates the next Litecoin halving, which is due early next month.

While LTC has suffered in the past few days, its chart suggests that it may be due a rebound anytime soon.

The coin's relative strength index has begun rising up from a low of 30, which indicates that it had been oversold in the past few days.

It's also worth pointing out that LTC's 30-day moving average (yellow) is close to falling below its 200-day average (blue), at which point it will be due to rebound once again.

However, LTC may fall a little further in the short-term, with the coin's support level (green) dropping in the the past week.

For this reason, traders probably shouldn't be surprised if they see the altcoin dip below $90 in the near term, something which it may have to do in order to begin further rallies.

But rallies are most likely due pretty soon, given that Litecoin's halving event is scheduled to take place in the first week of August.

As with Bitcoin halvings, Litecoin's will result in its block reward declining by 50%, something which in theory will make LTC scarcer and 'harder' as a cryptocurrency.

This could therefore increase demand for the altcoin in the next couple of weeks, although it's always possible that the halving could be a 'buy the rumor, sell the news' type of event, meaning that LTC may dip once the halving is

Read more on cryptonews.com