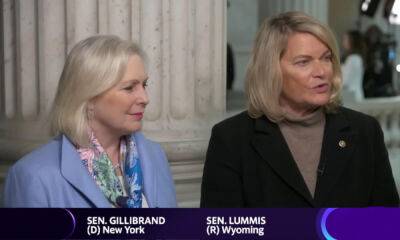

Law Decoded, June 7–13: Lummis-Gillibrand bill is finally here

One can hardly name a document more long-hoped-for as the crypto bill, co-sponsored by United States Senators Cynthia Lummis of Wyoming and Kirsten Gillibrand of New York, was for the crypto community. And, it’s finally here. Last week, Lummis and Gillibrand introduced a 69-page bill in the U.S. Senate. What’s inside? The projects of study on the environmental impact of digital assets and advisory committee on innovation, a tax structure, a mandate for analysis of the use of digital assets in retirement savings and much more.

Should it become law, the bill would undoubtedly implement major changes to the current regulatory landscape. Kirsten Gillibrand and Cynthia Lummis have confirmed that Bitcoin (BTC) and Ether (ETH) will be classified as commodities and regulated by the Commodity Futures Trading Commission (CFTC). At the same time, bill authors consider most altcoins securities subject to U.S. Securities and Exchange Commission (SEC) regulations. “It will be a struggle to decipher what exactly is in the SEC bucket, but it could be the exception that swallows the rule,” a worried expert told Cointelegraph.

Terraform Labs, the parent company behind the collapsed Terra ecosystem, continues its struggle with enforcement agencies and courts in both hemispheres. The Seoul Metropolitan Police Agency received an intelligence tip informing them of possible embezzlement of BTC by one of the firm’s employees, though not Do Kwon himself. But Kwon is still in enough trouble, as The United States Court of Appeals rejected his dispute of a subpoena by the SEC, ruling that it was served correctly.

Continue reading.

Major crypto exchange Binance suffered some heavy blows last week. The SEC investigated whether Binance Holdings broke

Read more on cointelegraph.com

![When will Bitcoin [BTC] make a comeback? This exec thinks… - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2022/7/11/33016_bezx.jpg)