Is It Too Late to Buy XDC Network? XDC Price Jumps 100% in 2 Weeks But Crypto Whales are Buying This Other Coin – Here's Why

Leading enterprise-aimed layer-1 blockchain XDC Network appears to be breaking out, following an impressive +100% pump in price over the past week.

The EVM-compatible blockchain ignited into life on July 18 as interest surged in conjunction with ETH Barcelona and ETH Toronto.

Following the surging price action, XDC is currently trading at $0.071 (a 24-hour change of -3.93%).

The -20% downtick in price comes due to local retracement moves after topside rejection from the upper trendline around $0.09.

This is little cause for concern, and remains characteristic of the aftermath following a significant price move up to a new resistance level.

Critical, XDC is still trading high above moving average levels, with the 20DMA still ascending to catch-up with price at $0.051.

While the 200DMA, which had provided steadfast support for technical structure for much of 2023, remains low at $0.035.

Indicators could raise some cause for concern following the +200% rally since mid-July.

On the recent push up XDC's RSI overheated to an alarming degree, with significant bearish divergence at 73.41 signalling that XDC Network might be highly overbought and due a correction.

The MACD stands emboldened by the upside swing, contrasting the RSI with bullish divergence at 0.0017.

Despite the significant upswing, XDC's risk: reward profile suggests that it might not be too late to buy XDC Network.

With the risk: reward at 1.5, upside potential is targeting resistance around $0.09 (+23.5%), whereas downside risk could see a drop down to lower support at (-15.3%).

Yet, with XDC in a precarious position on the price chart, many are looking to secure gains by rotating profits out of over-burdened Meta Mask wallets and into other lucrative plays.

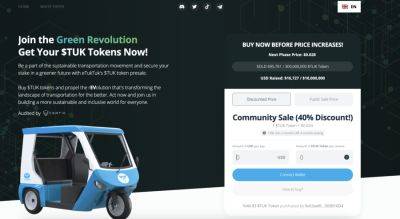

There's a new

Read more on cryptonews.com