IRS releases draft of proposed reporting rules for digital asset brokers

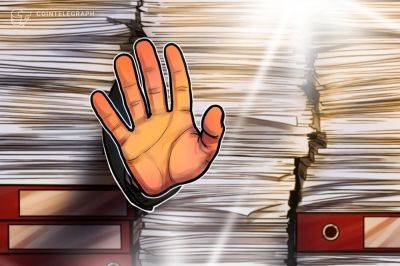

The United States Internal Revenue Service (IRS), the agency responsible for tax collection, released proposed regulations on the sale and exchange of digital assets by brokers. Under the rules, brokers would be required to use a new form to report to simplify tax filing and cut down on tax cheating.

The proposed Form 1099-DA would “help taxpayers determine if they owe taxes, and […] avoid having to make complicated calculations or pay digital asset tax preparation services in order to file their tax returns,” according to a Treasury Department statement. It added:

The regulations bring digital asset reporting into line with reporting on other types of assets, the Treasury said.

The draft proposal, set to run in the Federal Register on Aug. 29, is 282 pages long. It is part of the Biden administration’s implementation of the bipartisan Infrastructure Investment and Jobs Act (IIJA), the Treasury said. IIJA provisions are expected to raise $28 billion in new tax revenue over ten years.

Related: Elizabeth Warren, Bernie Sanders urge closure of ‘$50 billion crypto tax gap’

The proposed rules would go into effect in 2026 to reflect sales and exchanges carried out in 2025. Written comments on the proposal are being accepted through Oct. 30. At least one public hearing will be held after that date.

Judging from the initial reaction to the proposal, the IRS may have a lot of comments to field. Kristin Smith, CEO of the Blockchain Association, an industry advocacy group, released a statement that said:

Smith added that the group and its members were looking forward to providing comment.

Reuters quoted DeFi Education Fund CEO Miller Whitehouse-Levine as saying, “Today's proposal from the IRS is confusing, self-refuting, and

Read more on cointelegraph.com