Hong Kong Looks to Curb Retail Stablecoin Trading Amid Crypto Adoption

Hong Kong is considering measures to restrict retail stablecoin trading for individual investors in response to the increasing adoption of cryptocurrencies, as stated by a local official. It is important to note that retail stablecoin trading is currently not permitted in Hong Kong.

As reported by a local news agency, Ming Pao, on October 6, in a live interview on an investment committee program, Hui Ching-yu, the Secretary for Financial Services and the Treasury in Hong Kong, clarified that the city has not yet established regulations governing the trading of stablecoins such as Tether (USDT) or USD Coin (USDC). Consequently, retail investors are currently prohibited from engaging in such trading activities within the country.

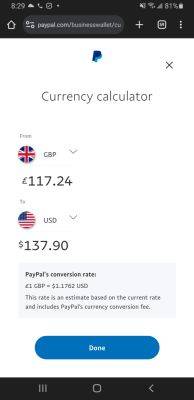

Stablecoins, which are cryptocurrencies pegged to the value of a fiat currency like the US dollar, are frequently used by service providers as a key trading asset to mitigate market volatility.

However, some stablecoins have experienced significant volatility or even collapsed in the past, as exemplified by the TerraUSD (UST) stablecoin collapse in May 2022. This highlights the critical role of reserve management in maintaining their price stability and safeguarding investors' rights to redeem fiat currencies.

Considering these risks, retail trading is allowed in the country once the regulator looks into it and officially regulates stablecoins, as Hui reportedly stated.

Hui Ching-yu referenced the ongoing JPEX fraud case, which is under investigation for fraudulent activities, reflecting that crypto activities within the country need supervision.

In another live interview, Xu Zhengyu, Secretary for Financial Services and the Treasury of the SAR government emphasized the risks associated with unregulated

Read more on cryptonews.com