Here’s What Treasury, Fed Might Do in a Debt Ceiling Crisis

U.S. regulators have long insisted that financial institutions have contingency plans for potential crises. A potential crisis now looms: an unprecedented default on Treasury debt. Yet the Biden administration has undermined contingency planning by refusing to say how it would respond.

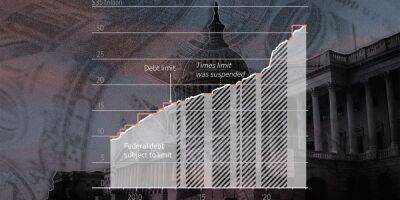

The government spends more than it brings in from tax revenue and must continuously borrow to cover the difference, causing the national debt to rise over time. But Congress sets a statutory ceiling on that debt, currently $31.4 trillion, which was reached in January. Treasury is using accounting maneuvers to meet its bills without breaching the ceiling, but it is expected to exhaust those options as early as June or possibly later in the summer.

Read more on wsj.com

wsj.com

wsj.com