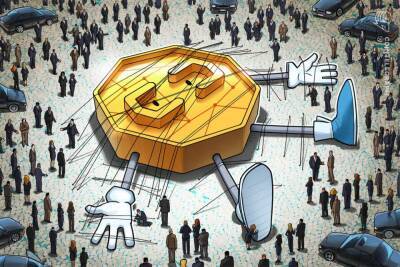

Google enters 10-year partnership with CME Group

In a sign that securities trading is making the inevitable shift to the cloud, the futures-exchange operator CME Group on 4 November announced a 10-year agreement with Google Cloud that it says will "transform derivatives markets through technology."

The companies didn't specify the dollar value of the agreement. But they also said that as part of the agreement, Alphabet's Google unit has invested $1bn in a new series of nonvoting convertible CME Group preferred stock. CME said it would use the funds for "its broader technology...

Read more on fnlondon.com

fnlondon.com

fnlondon.com