FTX is looking to raise another $1B and the reason is surprising

Sam Bankman-Fried’s Bahamian crypto exchange FTX is reportedly out to raise funds again, this time looking for investors to pump in as much as $1 billion in order to maintain its current valuation which is roughly $32 billion.

This is an ambitious plan, given the current crypto bear market, but the billionaire CEO of FTX has broken several industry norms during the contagion by going on a shopping spree when others conserved cash.

According to a report by CNBC, if the ongoing negotiations are successful, FTX will be able to retain its valuation. The fresh capital injection will also help bolster Sam Bankman-Fried’s ability to acquire more firms operating in the crypto industry.

Fresh funds may also help FTX get ahead in the race to acquire the assets of bankrupt crypto lender Voyager Digital. Binance currently leads the race with a bid of around $50 million, with FTX’s bid closely trailing.

The 30-year-old CEO has been rather active during the crypto winter, undertaking a bailout campaign of struggling crypto firms that saw names like BlockFi and Voyager Digital getting lines of credit worth several hundred million dollars.

While the agreement with BlockFi gives FTX the option to fully acquire the crippled crypto exchange, arrangements with bankrupt crypto lender Voyager have gone sour.

After failing to persuade Voyager’s investors to accept a buyout offer, FTX is now attempting to salvage what it can through Voyager’s auction that will conclude on 29 September.

It is interesting to note that Bankman-Fried has a personal stake of 7.6% in the trading platform Robinhood. He bought 56 million shares of the exchange back in May and paid close to $482 million for the purchase.

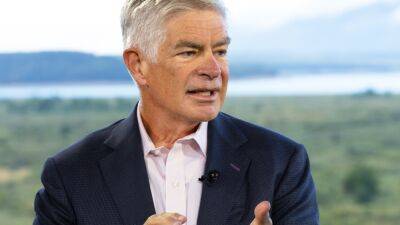

Brett Harrison, President of FTX United States

Read more on ambcrypto.com