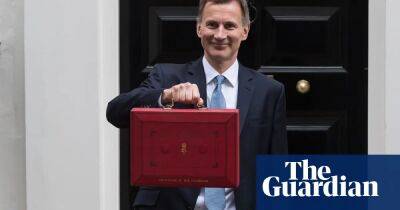

Five charts that will shape Jeremy Hunt’s budget

Jeremy Hunt will announce his budget on Wednesday with the government under pressure to provide more support on soaring living costs, and as the global economy grapples with the collapse of Silicon Valley Bank.

The chancellor is widely expected to announce an extension of financial support for energy bills and policies to encourage more people into work, alongside updated forecasts for the economy and public finances. Here are five key charts that will underpin his statement.

The UK’s annual inflation rate has eased for three consecutive months, although at 10.1% it is still at one of the highest levels in 40 years. It comes as global energy prices have fallen back in recent months, helping to bring down petrol and diesel prices.

After wholesale oil and gas prices surged after the Russian invasion of Ukraine a year ago, economists now expect them to help bring down headline inflation – possibly to below the Bank of England’s 2% target by the end of 2023.

Rishi Sunak’s government has promised halving inflation this year is one of his five key priorities. However, the Office for Budget Responsibility had already expected this to happen and will publish updated forecasts at the budget.

The drop in energy prices is expected to reduce the cost of the government’s support package for households and businesses. Alongside a stronger than expected economic performance, bolstering tax receipts, this should give the chancellor more headroom against his self-imposed borrowing and debt targets.

The budget deficit – the gap between public spending and income – for 2022-23 is expected to come in about £30bn lower than the OBR forecast in November.

The national debt – the sum total of every annual budget deficit – is also likely to be lower as

Read more on theguardian.com