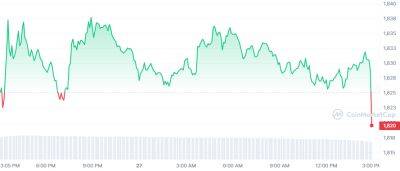

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank Collapse

The Federal Reserve’s banking supervisors failed to take forceful action to address growing problems at Silicon Valley Bank before it collapsed last month, the central bank’s top regulator said, signaling a broad push to toughen rules on the industry.

Michael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. When supervisors did find risks, they didn’t take sufficient steps to ensure the firm fixed those problems quickly enough, he said in a report Friday.

Read more on wsj.com

wsj.com

wsj.com