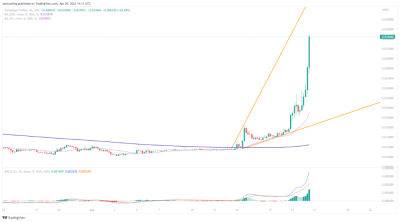

Ethereum Surges Above $2,100 Amid Bullish Post-Shapella Upgrade Supply Dynamics – Where Next for the ETH Price?

Ether (ETH), the cryptocurrency that powers the smart-contract-enabled Ethereum blockchain, just surged above $2,100 for the first time since May 2022 amid positive post-Shapella update changes in the ETH supply.

Ethereum developers successfully implemented the so-called “Shapella” upgrade on Wednesday – Shapella being an amalgamation of the names of Ethereum’s consensus (Shanghai) and execution (Capella) layers.

Among other things, the upgrade means that staked ETH and ETH-denominated staking rewards can now be withdrawn from the staking smart contract for the first time since staking was enabled on the Beacon blockchain back in December 2020.

Some analysts had worried that the enabling of withdrawals would lead to a rise in short-term sell pressure in the Ether market, as stakers look to cash in on their accrued yield, as well as ETH price appreciation since December 2020 of around 200%.

However, on-chain data reveals that Thursday actually saw a near 100,000 jump in the number of ETH tokens staked on the Ethereum blockchain, the largest one-day increase in nearly two months.

That suggests that rather than a greater proportion of investors withdrawing their staked ETH to cash in, a larger proportion have actually interpreted the successful implementation of the Shapella upgrade as a green light to finally stake their Ether tokens.

When more ETH tokens are locked up in staking contracts, this increases the scarcity of unstaked ETH tokens that can be traded across cryptocurrency exchanges.

This should arguably boost the ETH price, which appears to have been the case in light of the latest market moves.

Upside in the ETH price is likely also related to relief that there hasn’t been a flood of unstaked ETH entering the market and

Read more on cryptonews.com