Ethereum’s Growth Could Spike With Increased Institutional Investments In First Half of 2024: Coinbase

With a fresh analysis released on February 8, Coinbase’s research division shed light on the anticipated growth in Ethereum’s trading dynamics during the initial six months of 2024.

Coinbase analysts highlighted growth points after the approval of spot Bitcoin (BTC) ETFs in decentralized finance (DeFi) and the wider crypto market.

According to the report, Ethereum has moved slowly in recent months as Bitcoin continues to attract more institutional investments.

Despite Ethereum’s slow growth compared to others, analysts project institutional investments in the first half of the year have the potential to change the narrative.

“…we believe there’s room for ETH to play catch up to its peers in 1H24. Although there was some rotation into ETH after the launch of spot bitcoin ETFs, the momentum was arrested by liquidations from a large defunct crypto lender alongside pressure from the sale of ETH options.”

The anticipation of growth largely banks on the potential approval of spot Ethereum ETFs, mirroring the market acceptance Bitcoin has enjoyed. Such a move could open up new windows of opportunity for Ethereum.

ETH gained over 80% in 2023 and recorded increasing DeFi numbers and institutional fund investment despite playing second fiddle to Bitcoin’s soaring ETF narratives.

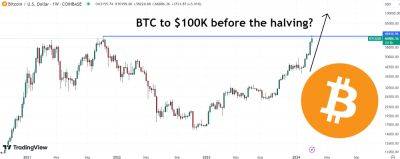

Bitcoin led the pack with over 158% gains in 2023 as institutional funds trickled in from BlackRock’s ETF application wiping out losses from the horrid crypto winter in 2022.

Ethereum’s growth on the institutional front was also overshadowed by Solana (SOL) which recorded a string of inflows into investment funds earning the description as an institutional investor favorite.

This year, the approval of spot Bitcoin ETFs has seen flows into the market leader and

Read more on cryptonews.com