Ethereum nosedives below $1500 after Merge upgrade

Merge, Ethereum (ETH) registered its biggest fall in a month on Friday, breaching $1,500 in a knee-jerk reaction after the network overhaul. The second-largest crypto asset, which has shifted its mechanism to proof-of-stake (PoS) from proof-of-work (Pow), in a one-of-a-kind upgrade, had topped $2,000 due to the Merge euphoria but took a sudden beating. Ethereum tumbled roughly 12 per cent from the $1,645 mark to test $1,450 levels on Friday before trading around $1,475 at 13.20 hours IST, the data from coinmarketcap suggested. Ethereum's total m-cap plunged to $180.25 billion, and its volumes sank 14 per cent as tokens worth $20.8 billion exchanged hands in the last 24 hours, suggests data.

Did you Know?

From tracking sustainability of products to monitoring pollution, environmental researchers are now finding blockchain’s use in solving the climate crisis.

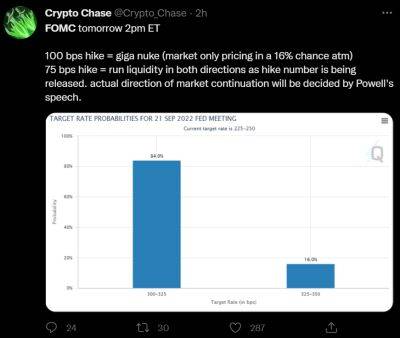

View Details »However, Ethereum was not the sole crypto token in troubled waters, but among the top-20 crypto tokens, it was the biggest loser. Other tokens, including Bitcoin, Dogecoin and Shiba Inu, declined 2-4 per cent each. Edul Patel, CEO and co-founder, Mudrex, said that majority of the tokens dropped as the sentiment around cryptos remains bearish and market participants look for clues about the pace of interest rate hikes. Despite the success of Merge, Ethereum breached the $1,500 mark, he said. «ETH's next primary support level is at $1,400, while the immediate resistance is $1,500. If it fails to hold these levels, we may see Ethereum test the $1,300 level.» However, experts believe there is no fundamental reason behind this steep fall. «It's more about the speculative tussle between the bulls and bears to profit from their respective positions,» said

Read more on economictimes.indiatimes.com

![Bitcoin [BTC] investors looking for relief might get some after reading this - ambcrypto.com - city Santiment](https://finance-news.co/storage/thumbs_400/img/2022/9/22/41942_lmsir.jpg)