Ethereum may drop to $1k for the first time in two months if…

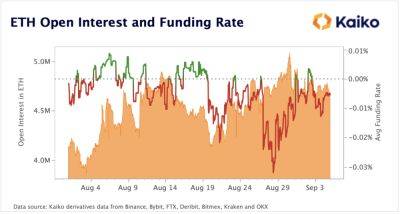

Ethereum [ETH], the largest altcoin remains hyped due to the upcoming upgrades in September. Despite that, traders have had a hard time trusting ETH with their life savings as falling funding rates continued.

But for how long? Could one see a price uptick amidst the sea waves of fear across the network?

Ethereum has been falling underneath a descending resistance line since reaching an all-time high price of $4,868 in November 2021. Even at press time, ETH suffered a fresh 2% correction as it traded shy of the $1.6k mark.

Source: CoinMarketCap

The Ethereum disbelief is strong from traders during a particularly volatile week of trading. The crowd have shorted (sell), across exchanges, at the largest ratio since June of 2021.

Notably, the funding rate fell significantly on 28 and 29 August. In fact, even at press time, on 31 August, the rate consolidated at the same level.

To put it simply, the token’s funding rates dipped to its ‘most extreme’ zone on Santiment.

Source: Santiment

A negative value signified that short traders paid a premium to long traders in order to hold onto their positions.

However, traders shouldn’t really give up as such scenarios in the past led to a price hike.

Historically, price rises were prevalent in these conditions. As was the case at the time of writing as a U-turn could be seen in the average funding rate, which stood just above the $0 mark.

Is recovery possible due to a potential short-squeeze? Well, yes, that’s a possibility. The last time funding rates were this negative, was in July 2021, just before a huge short-squeeze on Ethereum.

A short squeeze happens when the price of an asset sharply increases due to a lot of short sellers being forced out of their positions.

Similarly, ETH could see a price

Read more on ambcrypto.com