Dutch exchange Bitvavo rejects DCG’s proposal to repay 70% of debt

Cryptocurrency exchange Bitvavo, a major creditor of the troubled crypto company Digital Currency Group (DCG), has dismissed DCG’s proposal of partial debt repayment.

Bitvavo officially announced on Jan. 11 that the firm received a counter proposal from DCG offering to repay about 70% of the outstanding amount in a term acceptable to Bitvavo.

The remaining balance amount is still under negotiation with DCG as it is only ready to repay part of the debt within a term acceptable for Bitvavo, the exchange said, adding:

Bitvavo emphasized that the current situation regarding DCG has no impact on Bitvavo's customers, its platform and its services. “Bitvavo guarantees the outstanding amount and has thus taken over the risk from its customers,” the firm noted.

The announcement came soon after Bitvavo decided to prefund about $290 million in assets locked on DCG in order to avoid reliance on the troubled firm. The Dutch crypto exchange said that it had enough resources to continue serving its customers with no disruption. The exchange expects DCG to refund outstanding balances despite the latter experiencing a massive liquidity crisis amid the bear market.

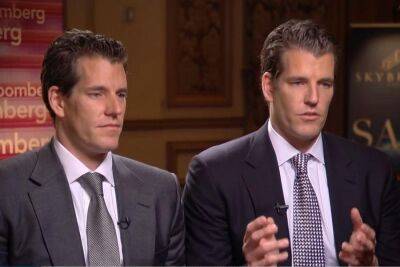

In the latest statement, Bitvavo mentioned a similar situation faced by Winklevoss brothers’ crypto exchange Gemini. On Jan. 10, Cameron Winklevoss wrote a public letter to the DCG board, accusing CEO Barry Silbert of fraud and calling for replacing the exec as CEO. With DCG and its crypto lending subsidiary Genesis owing Gemini $900 million, Gemini founders are confident that there’s still a possibility of a positive solution to the satisfaction of all parties involved.

“Like Gemini, we share the confidence that a solution can be found to the satisfaction of all involved,” Bitvavo

Read more on cointelegraph.com

cointelegraph.com

cointelegraph.com