DTCC Declares No Collateral Value for Bitcoin-Linked ETFs, Impacting Loan Extensions

The Depository Trust and Clearing Corporation (DTCC) has announced that it will not assign any collateral value to exchange-traded funds (ETFs) with exposure to Bitcoin or cryptocurrencies.

Additionally, the DTCC, a prominent financial services company specializing in clearing and settlement services, will not extend loans against these assets, according to a Friday announcement .

The decision will take effect from April 30.

The DTCC’s declaration implies that ETFs and similar investment instruments with Bitcoin or other cryptocurrencies as underlying assets will experience a complete removal of their collateral value.

In a post on X, ccryptocurrency enthusiast K.O. Kryptowaluty clarified that this change would primarily impact inter-entity settlements within the line of credit system.

Individual brokers, depending on their risk tolerance, may continue using cryptocurrency ETFs for lending and as collateral in brokerage activities without major repercussions.

The DTC system, or Depository Trust Company, is a key component of the financial infrastructure of the United States, acting as the central securities depository. DTC is part of a larger organization called the Depository Trust & Clearing Corporation (DTCC)

what you write…

— K.O Kryptowaluty (@KO_Kryptowaluty) April 27, 2024

While the DTCC has taken a firm stance against crypto ETFs, other traditional players have shown a different approach.

Clients of Goldman Sachs have reentered the cryptocurrency market in 2024, driven by renewed interest following the approval of spot Bitcoin ETFs.

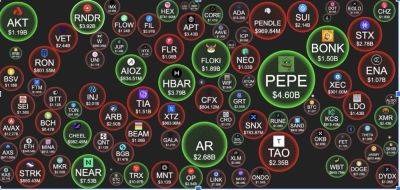

The introduction of spot Bitcoin ETFs in the United States has sparked increased institutional interest in this investment product.

Within just three months of their

Read more on cryptonews.com