Dogecoin, Shiba Inu bleed as market braces itself for FTX-like scenario

Prominent meme coins like Dogecoin [DOGE] and Shiba Inu [SHIB] traded in the red as the FUD triggered by the collapse of the crypto-friendly bank, Silvergate, continued to engulf the broader cryptocurrency market.

According to data from CoinMarketCap, the market cap of top meme tokens fell by 9% in the 24-hr period while the trading volume surged 23.86%, indicating that an intense market sell off was underway.

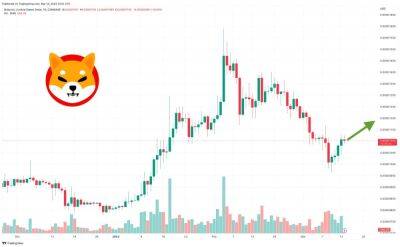

Additional data highlighted that at the time of writing, DOGE, which is the largest meme coin by market cap, was down 8.24% in the 24-hour period while SHIB fell by over 9% in the same time.

Both the coins registered double-digit losses in the last seven days and were among the worst-performing cryptos in the market.

Read Shiba Inu’s [SHIB] Price Prediction 2023-24

Shares of crypto-related companies and coins came crashing down after Silvergate Capital Corp, a major crypto lender in the market, announced that it will shut down its operations and voluntarily liquidate.

Silvergate became the latest victim of a wider market downturn that was initiated majorly after the FTX collapse last year.

Following this development, Bitcoin [BTC] plunged below the $20,000 mark for the first time in nearly two months. The contagion spread to other cryptocurrencies as well and meme coins were one of the biggest losers.

According to Santiment, SHIB’s supply on exchanges increased steadily over the past week and reached the weekly high on 8 March. This suggested that users were possibly selling off their holdings.

The number of whale transactions more than doubled over the last seven days, implying that even bigger addresses had started to dump SHIB. The supply held by top addressees also increased, though it was not a very significant

Read more on ambcrypto.com