Dogecoin Price Prediction as CNBC’s Jim Cramer Says DOGE is About to Collapse – Best Inverse Indicator?

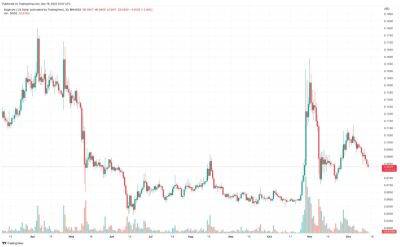

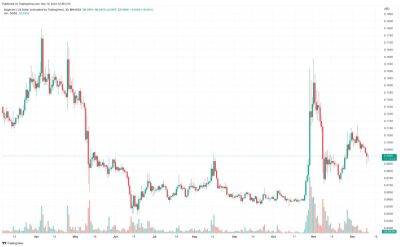

DOGE, the native cryptocurrency that powers the Dogecoin blockchain, was last changing hands about 4.5% lower on the day on Monday just to the south of the $0.09 level, extending on Sunday’s 3.6% decline. Though Dogecoin has managed to recover from earlier session lows under $0.0850, at current levels in the $0.0880s, the cryptocurrency is still trading about 20% lower versus its earlier monthly highs just above $0.11. Its gains versus its November lows in the low-$0.07s, while still decent at around 23%, have been substantially eroded. As a result, price predictions have become somewhat more pessimistic.

Monday’s drop marks a break below an important area of technical support in the form of the August highs (around $0.0910) and the 62.8% Fibonacci retracement level back from the early November highs around $0.16 to the annual lows just under $0.05. Dogecoin bears will be targeting a retest of key next key support area in the low $0.07s, where the 200-Day Moving Average (DMA) and November double-bottom lows reside.

Looking ahead, Dogecoin will be taking its cue from broader macro themes this week, just like the broader cryptocurrency market. And it’s a big week on the macro front. US CPI data for November is out on Tuesday, with investors hoping for further evidence of inflation falling quickly back to the Fed’s 2.0% target. The Fed will then announce its latest interest rate decision alongside fresh economic and interest rate path forecasts, plus the usual press conference with Fed head Jerome Powell. The BoE and ECB will also be deciding on interest rates this week, and preliminary PMI data for December is out.

Last week, famous US TV personality and host of CNBC show Mad Money Jim Cramer made headlines by criticizing

Read more on cryptonews.com