Decentralized Finance Activity Hit Hard As Crypto Markets Tumble

DeFi activity is robbing lenders of their most lucrative returns.

Crypto lending may not be down and out, but it's certainly on the ropes.

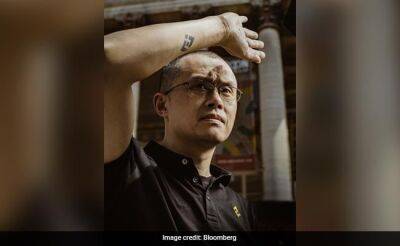

Crypto lenders have boomed over the past two years, attracting tens of billions of dollars in bitcoin, ether and other coins which they in turn lent out or invested, often in decentralized finance (DeFi) projects with sky-high returns.

But as crypto markets tumble, DeFi activity is being hit particularly hard, robbing lenders of their most lucrative returns and threatening to squeeze the whole sector - reaching far beyond Celsius Network, which grabbed the headlines last week when it froze withdrawals and transfers.

The total value locked (TVL) on ethereum, a metric that attempts to track the value of tokens deposited in a variety of DeFi protocols, has declined by $124 billion or 60% over the last six weeks, according to data provider Glassnode.

The crash has occurred in two large crypto slices, $94 billion lost during the collapse of the LUNA project - involving failed stablecoin TerraUSD - and another $30 billion in mid-June, said Glassnode, which attributed the falls to diminishing risk appetite.

"The current market conditions have put an enormous amount of pressure on operators that interact with decentralized finance protocols to generate their yield," said Mauricio Di Bartolomeo, co-founder and chief strategy officer of crypto lender Ledn.

Bitcoin Vs Ether Vs Dollar

Similarly, an index tracking crypto tokens linked to DeFi lending/borrowing protocols and exchanges, from research firm Macrohive, plunged 35% last week as investors pulled money from the formerly high-flying sector.

Some DeFi protocols, or projects, are starting to offer lower returns, with average lending and borrowing

Read more on ndtv.com