Crypto is a very interesting long-term story, says Christopher Wood

Christopher Wood, Global Head, Equity Strategy at Jefferies, says cryptocurrencies remain a “vulnerable asset class” but bitcoin stands to gain with the Federal Reserve planning to tighten liquidity and hike rates.

In an exclusive interview to CNBC-TV18, Woods, who talked about a range of subjects, said India looked set to record perhaps best earnings growth in Asia and could be one of the best-performing markets like in 2003 and 2007.

He continues to be bullish on the energy sectors but also sees high oil prices as a short-term risk to Indian markets.

Here is what he said to CNBC-TV18 on crypto, crude and energy sector:

‘Interesting, long-term story’

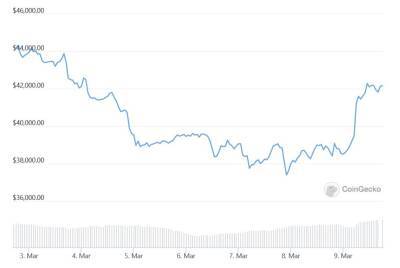

Wood said tightening by the Federal Reserve was likely to accelerate bitcoin’s outperformance in comparison to other cryptocurrencies, as the world’s largest crypto was a store of value, akin to gold.

Other popular cryptos like ethereum and solana were akin to high-beta tech stocks, which entail extremely high risk and volatility, said Wood.

The monetary tightening by Fed would likely impact risk-prone sectors like tech and biotechnology, given that they are majorly long-term growth stories that come with a lack of profit in the short run.

Crypto, for him, is disruptive in the long run—the next five-10 years—and is, not a one-play, single-year act.

“Crypto has the potential to disintermediate the banking system with DeFi and blockchain technology since people are already lending and borrowing over the system,” he said, referring to the so-called decentralised finance.

Bullish on metaverse

Wood was also bullish on metaverse, the immersive virtual worlds that big tech companies are racing to build, and “Web 3.0”, saying if the Fed were not to implement tightening, these areas could

Read more on moneycontrol.com