Cointelegraph Consulting: Comeback clues from January’s crypto cold spell

With key stakeholders taking profits and confidence in buying the dip staying high, traders who were overzealous about a quick Bitcoin rebound back to all-time high levels were punished with further price declines.

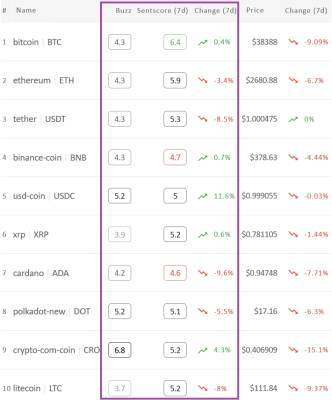

Although Bitcoin (BTC) has subtly bounced since dropping below $34,000 in late January, its price is still down 20% in the last 30 days. Ether (ETH) has fared worse, dropping 30% in this same timeframe. This edition of the Market Insight’s newsletter takes a deeper look at the data behind the cryptocurrency market’s performance in the past month.

For example, Bitcoin’s key whale trader tier, typically comprising addresses holding between 100 and 10,000 BTC, has dumped approximately 150,000 BTC in the past three months.

The supply held by this group is very often used as a primary leading indicator for where prices will head next. The current supply held by these whale addresses has dropped to 47.31%, within sight of the one-year low of 47.20% held back in mid-May when prices were declining swiftly.

Santiment’s Network Value to Transactions Ratio (NVT) model measures the amount of unique BTC circulating on the network, then calculates whether that output is above, on par, or below the expected amount of circulation to justify Bitcoin’s current market capitalization.

There has been a healthy and expected amount of tokens moved since October 2021. When prices were falling during the first half of January, the month lacked the necessary circulation to keep prices above $40,000. However, on average, the month of January presented a semi-bullish signal after some dip buying and increased activity.

As a bonus, February has started off in bullish circulation territory. It can be concluded that once some other metrics align

Read more on cointelegraph.com