CBDCs on the horizon: The current state of CBDC initiatives around the world

Central bank digital currencies (CBDCs) have long been a topic of contested discussion, having often been met with a predominantly negative response in the crypto community. However, despite the skepticism, CBDCs undeniably serve as a significant use case for blockchain technology.

BDCs distributed through blockchain technology can provide cheaper, faster and possibly more accessible transactions than traditional banking systems, while also possessing the potential to more effectively counter illegal financial activity, including money laundering. Still, whether these benefits are worth the increased control by governments over citizens’ finances and the risks of system failure when central banks make mistakes is an open question for debate.

Cointelegraph Research maintains its CBDC Database in order to provide an up-to-date overview of the worldwide state of CBDC projects, gathering all the available data on the existing initiatives in this field.

The number of existing CBDC projects has increased significantly over the past few years. Currently, over 100 countries are exploring the topic of CBDCs, and while approximately half of them are still in the stage of research and development, there are 39 countries that have either pilot, proof-of-concept or launched CBDC initiatives.

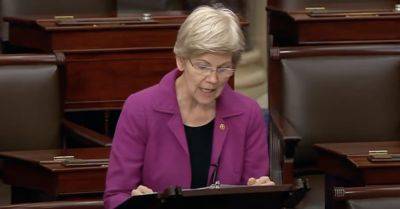

Particularly interesting is the process of CBDC discussion in countries where financial freedom is a topic of constant debate, such as the United States and Canada, especially given that many conservative politicians have strongly criticized or even prohibited the introduction of CBDCs.

In particular, Florida has already banned the usage of a potential U.S. CBDC in the state, while a whole group of states — including Alabama, Louisiana, North

Read more on cointelegraph.com