Can Cardano [ADA] see a pullback to $0.3? Here’s why it’s possible

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

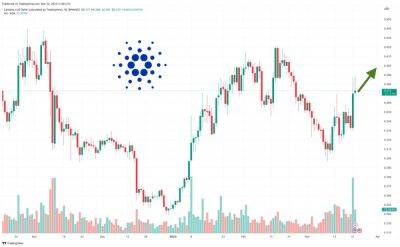

Cardano [ADA] was in a downtrend from 16 February to 11 March, but over the past ten days, it had retraced a good portion of those losses. The bulls could push the prices as high as $0.368 but could not achieve a strong breakout past a zone of resistance on the four-hour chart.

How much are 1,10,100 ADAs worth today?

Bitcoin [BTC] pulled back from the $28k region but hasn’t yet flipped its bias to bearish. The $28k-$30k was strong resistance. On the lower timeframe charts, Cardano showed signs of bearish momentum taking over.

Source: ADA/USDT on TradingView

The red box in the $0.35 area highlighted a bearish breaker block from the four-hour timeframe. The price saw an H4 session close above it, but then the bulls were immediately rebuffed. This suggested that the move upward could have been a liquidity hunt.

On higher timeframes such as the daily, it was seen that ADA traded within a range from $0.23 to $0.42, with the mid-range at $0.33. This was the level of support that ADA held on to at the time of writing. The Bollinger band width indicator showed relatively lowered volatility over the past few days.

At the same time, a pennant pattern (white) was spotted on the charts. However, this was not a bull pennant, as the flagpole was tiny. But it did signify a period of compression, backed by the BB width indicator findings.

A breakout on either side could follow this phase of compression. The RSI was below the neutral 50 mark, and the market structure was also bearish in the one-hour timeframe. This suggested that a breakout could be southward. A move beneath $0.33 and a retest of

Read more on ambcrypto.com

![Cardano [ADA] hits a price ceiling of $0.388 – Are more gains unlikely? - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/3/25/61493_zjcnc.jpg)

![Charles Hoskinson - How Cardano [ADA] shrugged off losses, extended growth hike across board - ambcrypto.com - city Santiment](https://finance-news.co/storage/thumbs_400/img/2023/3/23/61180_rtrl.jpg)

![Jared Grey - Evaluating SushiSwap’s [SUSHI] renewed tenacity amid possible tribulation - ambcrypto.com - city Santiment](https://finance-news.co/storage/thumbs_400/img/2023/3/22/61102_ooq.jpg)