Bitcoin Price Takes Breather at $21k Two Month High - Is $30k by End of Month Possible?

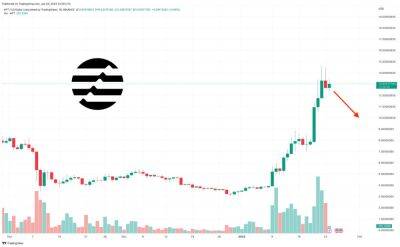

Bitcoin price is extending the week-long rally that has seen it blast past $20,000 for the first time since early November. Bulls have $24,000 in sight, but first, they must disperse the stubborn seller congestion zone at $21,000.

Over the last two weeks, Bitcoin price has disapproved calls for further downside action to $13,000 and $9,000, and analysts are changing the tune in favor of a sustainable bullish breakout.

The bullish outlook in BTC price started after flipping above the 50-day Exponential Moving Average (EMA) (in red). However, the next break past the 100-day EMA (in blue) resolved the bulls' presence in the market, paving the way for a much-needed move through the falling trend line (dotted).

Bitcoin price now trades at $20,720 after tagging a new yearly high of $21,383 as the green candle stretched its wick. A breakthrough resistance at the 200-day EMA (in purple) is necessary for BTC to confirm a macro bullish outlook.

Altcoin Sherpa, a popular crypto analyst and trader, told his more than 188k followers on Twitter that investors should consider taking profit at the 200-day EMA – supply zone. "Overall move looks a bit overextended and a pullback should be coming. Still don't think this is the overall macro bottom but let's see," he wrote.

Therefore, a daily close above this level would be crucial for Bitcoin price as bulls push for another sharp move to $24,000 and $30,000 after that. Failure to do so would encourage more investors to book profits with the hope of buying a low-priced BTC downhill.

According to another crypto analyst, Mags, "Bitcoin price is closing in on the mid-range level around $21,500." It is worth mentioning that the price has erased the entire FTX implosion dump. From here, the "best case

Read more on cryptonews.com