Bitcoin price sets new May high above $29.5K as traders eye breakout

Bitcoin (BTC) eyed a reclaim of further lost ground on May 5 as $30,000 remained in play.

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it spiked to $29,529 on Bitstamp - a new May high.

The pair had dipped with United States equities at the Wall Street open the day prior, but the weakness was short lived as $29,000 support returned.

Ongoing market jitters from the U.S. banking crisis, now impacting several regional banks, continued to shape observer sentiment.

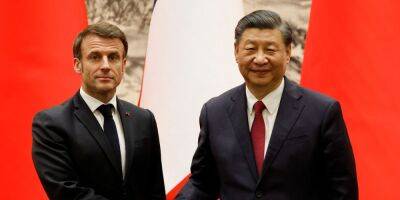

What are we drinking this weekend, left or right bank? pic.twitter.com/Mp2yXcI2Fa

“100% of all regional banks in the United States have their stocks in the red today, for the first time ever,” crypto media account Whalewire noted on Twitter.

Financial commentary resource, The Kobeissi Letter, considered the potential for the fallout to continue to ripple outward.

"Today is the first day since March that markets are taking the banking crisis seriously," it argued as stocks and crypto fell.

After the Federal Reserve raised interest rates this week, market expectations nonetheless pivoted to predicting an end to the hiking cycle. According to CME Group's FedWatch Tool, the next rate decision, due in mid-June, will not result in another shift higher.

When it came to BTC price action, traders eyed the potential for a closer rematch with $30,000 and higher.

Related: BTC price may need a $24.4K dip as Bitcoin speculators stay in profit

$BTC / $USD - Update Playing around with ideas at the moment on #Bitcoin .. Now i do not use these sort of trend lines often, but i cannot ignore this one as coincides nicely with the range high i am looking for us to hold Best case we tap range $32,000 and dump pic.twitter.com/1J7JfGzCvg

Popular trader Alan, known as

Read more on cointelegraph.com