Bitcoin Price Prediction: Navigating Moody's Rating Cut and Banking Crisis

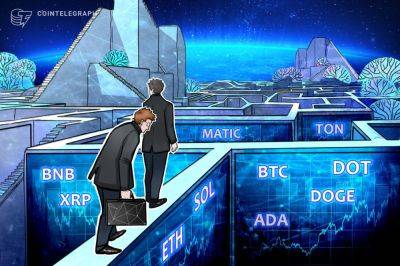

The BTC/USD pair is currently experiencing a decline of nearly 0.50%, trading at $29,597 as it braces for the impact of the upcoming US Consumer Price Index (CPI) release.

Amidst this market backdrop, Bitcoin continues to demonstrate its resilience despite challenges such as Moody's rating cut and a banking crisis.

Additionally, Galaxy Digital, buoyed by the surge in Bitcoin's value and its diverse business ventures, has reported impressive earnings. However, Bitcoin finds itself under pressure due to the strength of the US Dollar.

In this Bitcoin price prediction, we delve into the key factors shaping the cryptocurrency's journey in the face of these dynamics.

Moody's downgraded 10 US banks and may downgrade Bank of New York Mellon, US Bancorp, State Street, and Northern Trust.

Earlier this year, the crisis within US banks caused a significant increase in the value of Bitcoin as investors turned to the network as an alternative financial system.

Notably, the volatility in Bitcoin and Ethereum trading substantially decreased in May after the apparent resolution of the banking crisis, reaching multi-year lows.

Bitcoin has proved to be resilient, demonstrating a divergence from the stock market's fluctuations.

The relationship between the stock market and Bitcoin is decoupling, with Bitcoin emerging as a beneficiary of the banking turmoil.

Galaxy Digital, led by Michael Novogratz, reported a $46 million net loss for Q2, an improvement from last year's $555 million loss, thanks in part to Bitcoin's 80% surge in H1.

Despite regulatory challenges, Galaxy Digital's diverse business segments remain resilient, with asset management revenue skyrocketing by 619% to reach $33.8 million.

Trading revenues were down 54% to $59.5 million

Read more on cryptonews.com