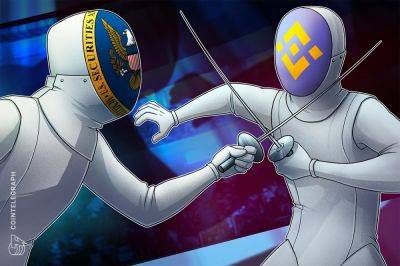

Bitcoin Price Prediction: MicroStrategy Boost, Binance's UK Halt, and BlackRock's ETF Snub

In a rollercoaster week for Bitcoin, the premier cryptocurrency saw its price rise to $28,400, marking a 4.5% uptick on Tuesday. Several significant events influenced this trajectory.

MicroStrategy's mammoth Bitcoin purchase acted as a bullish signal, offering some warmth during the prevailing crypto winter.

However, not all news was positive; Binance, one of the world's largest crypto exchanges, halted new user registrations in the UK, succumbing to the pressure from the Financial Conduct Authority (FCA).

In another setback, BlackRock, the global investment giant, dismissed a Bitcoin ETF report, causing the digital asset to waver.

The confluence of these events sets a complex stage for Bitcoin's short-term price predictions.

MicroStrategy (NASDAQ: MSTR), the top corporate Bitcoin holder, recently bolstered its Bitcoin cache to over $4.8 billion despite its stock plunging 30% during the crypto winter.

While serving industry leaders like Pfizer, Sony, Visa, and Hilton, the company retains its unwavering Bitcoin conviction, with no current liquidation plans.

Since its Bitcoin venture in 2020, MicroStrategy's stock has seen an upward trajectory.

This steadfast commitment to Bitcoin propels BTC's price upwards, hinting at the asset's promising long-term value, especially considering events like the impending Bitcoin halving and forecasted interest rate cuts by 2024.

Binance, a prominent cryptocurrency exchange, has suspended new user registrations in the UK as a response to the Financial Conduct Authority's (FCA) stringent approach towards cryptocurrency regulation.

The FCA recently enforced new rules on crypto asset promotions, effective from October 8, which require overseas firms, like Binance, to collaborate with

Read more on cryptonews.com