Bitcoin Price Prediction as US Debt Default Looms – Is BTC a Safe Haven?

As the possibility of a US debt default looms, the Bitcoin price prediction gains increased attention.

With the potential turmoil in the financial markets, investors are looking for safe-haven assets to protect their wealth.

Bitcoin, as a decentralized and borderless digital currency, has been hailed by some as a potential store of value during uncertain times.

In this Bitcoin price prediction, we will explore the dynamics of the Bitcoin price amidst the US debt default concerns and examine whether Bitcoin can indeed serve as a safe haven in such situations.

Tensions are escalating as the deadline approaches for the US to raise its spending limits and avoid a potentially catastrophic default.

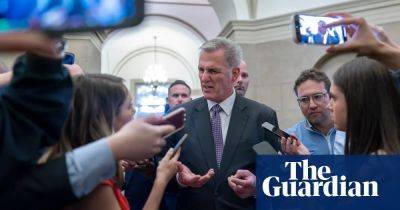

Negotiations between Republican House Speaker Kevin McCarthy and US President Joe Biden are ongoing, with the United States Department of the Treasury warning of a possible fund shortage by June 1.

The situation has led to a standoff, as McCarthy insists on spending cuts for social programs as a condition for raising the debt ceiling. The consequences of a default could severely affect the US and global economies.

Here's a summary of the current situation, including key players, potential outcomes, and the implications of a US debt default.

Stay informed and watch for updates as the US debt ceiling deadline approaches, potentially impacting the US economy and global financial stability.

The current price of Bitcoin is $26,801, and its trading volume over the past 24 hours amounts to $9.6 billion.

In the same timeframe, Bitcoin has experienced a decrease of less than 0.50%. It currently holds the top position on CoinMarketCap with a market capitalization of $520 billion.

There are currently 19,380,362 BTC coins in circulation out of a

Read more on cryptonews.com